Industrial Gas Turbines (IGT)

Industrial Gas Turbines (IGT) saw 4.2% growth between 2023 and 2024 but are projected to contract by 2.9% in 2025. Still, the long-term CAGR is estimated at 1.9% through 2026. While short- term trends are uneven, the long-term outlook is more bullish. Gas turbines are expected to play a critical role in powering data centers that support artificial intelligence—a market with vast energy demands.

Near-term IGT market softness is likely temporary. Long-term prospects remain favorable, especially with the surge in AI-driven data center energy demand and expanded use of natural gas as a transitional fuel.

Automotive

Automotive saw solid demand in 2024, with the investment casting segment benefiting from both internal combustion and electric vehicle (EV) platforms. Data on U.S. passenger miles driven and light truck/auto assembly volumes from 2021 to 2027 confirm steady vehicle production. EVs continue to capture share, and cast components for drivetrain and thermal systems remain critical.

While vehicle assemblies in North America are stabilizing, technology shifts continue to reshape demand. Internal combustion engine (ICE) assemblies are declining slightly, while EVs are rising steadily.

Investment castings remain essential for EV drivetrain components, turbocharger parts, and thermal management systems.

General Industry

General Industry showed growth in several key areas:

Industrial Production: Annualized rates improved year over year from 2020 to 2024. Month-to-month industrial growth in 2023 vs. 2024 was also positive.

Firearms: U.S. firearm production across categories (pistols, revolvers, rifles, shotguns, and miscellaneous) remained robust from 2021–2024.

Oil & Gas: North American rig counts showed a strong CAGR from 2020–2024. While regional growth varied (Europe, APAC, Middle East), key metrics—including crude oil production, gas production, and casting demand—rose year over year. WTI spot prices and average pump prices tracked upward as well.

Orthopedic Implants: Industry trends were positive in 2024, with strong growth forecasts into 2025. Demand for cast orthopedic components— especially knees—is expected to remain elevated through 2027.

Medium & Heavy Truck Assemblies: Moderate growth continues, with positive CAGR figures in 2024 and further expansion forecast for 2025.

Market Forces & Policy Impacts

2024 was another year of policy whiplash, particularly around tariffs. Announcements, reversals, and reim- positions kept manufacturers on edge and led many to renegotiate shipping terms to account for changing costs. Meanwhile, government incentives including tariffs on imported vehicles- are prompting manufacturers to reassess production locations and reinvest in North America. Environmental priorities are also shaping operations. Sustainability, resource optimization, and energy sourcing are now central to business strategy. These trends bode well for investment casting. As reshoring accelerates and U.S.-based production scales, demand for precision metal components is increasing across aerospace, automotive, energy, and industrial markets. 2025 will likely continue this expansion, albeit with caution around macro volatility.

Labor and Supply Chain

Labor remains a limiting factor. While hiring improved in 2024, most foundries still report extended lead times compared to pre-pandemic norms.

Trade & Tariffs

The status of US tarriffs remains fluid. These shifts created uncertainty across the supply chain, impacting sourcing strategies and inventory management. New duties on key components from Asia may introduce fresh challenges. As a result, U.S. investment casters are increasingly exploring domestic and nearshore suppliers to stabilize costs and lead times. Continued policy fluctuations are expected to influence purchasing behavior well into 2025.

Government Incentives

Policy-driven reshoring is accelerating. The CHIPS and Science Act, IRA, and infrastructure investments are spurring manufacturing growth.

-

$614 billion+ committed to U.S. reshoring and FDI projects since 2021

-

Tariffs on imported autos are pushing OEMs to localize more production

-

Sustainability mandates are increas- ing use of resource-efficient casting processes

Final Outlook

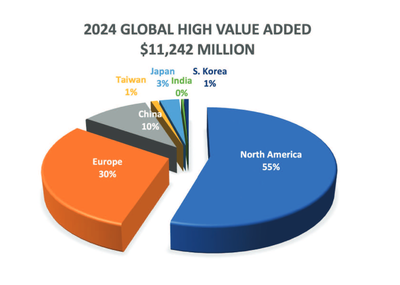

Across virtually every sector, investment casting demand in North America is expanding—driven by geopolitical forces, technology shifts, and policy support for domestic manufacturing. Aerospace remains the industry's linchpin, while general industry, IGT, and automotive provide diversification and growth opportunity.

With solid fundamentals and increased domestic manufacturing investment, the 2025 outlook is bright—tempered only by persistent workforce constraints and global trade uncertainty.